HireSmart Founders Talk With Teens About Being Smart With That Paycheck

You landed the job, and And you got that paycheck. Yay! Now what?

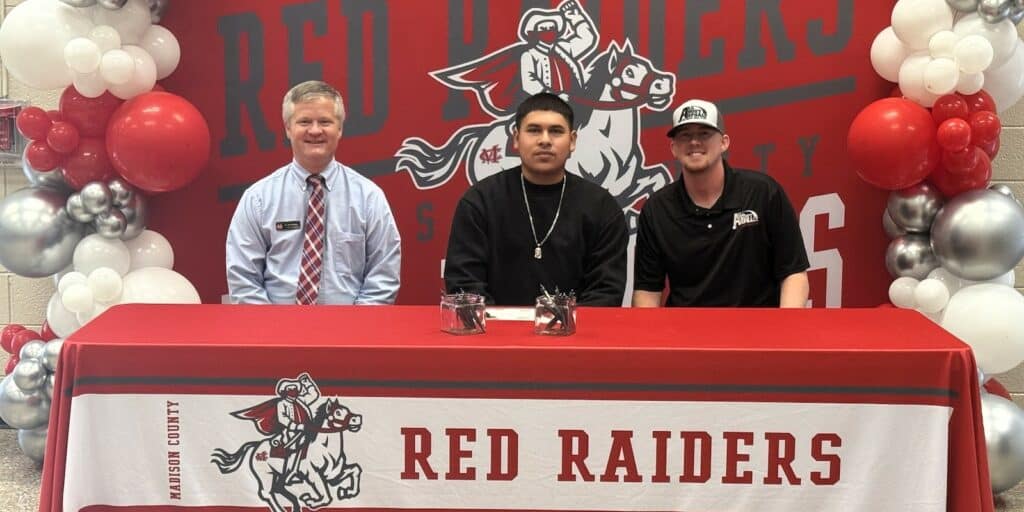

HireSmart Cares founders Mark and Anne Lackey recently talked about personal finances with students in Melinda Cochran-Davis’s construction classes at Jackson Empower College and Career Center in Jefferson, Georgia.

What does it take to live?

Mark and Anne praised Cochran-Davis’s work with the students on budgeting. Davis assigned each student a salary based on their grade-point average in the class, with A’s earning the most, followed by B’s and C’s. Students then had to allocate their income toward living expenses, including rent, auto costs, food, insurance, utilities, entertainment, etc.

“This is a great tool!” said Mark, noting the importance of careful budgeting.

Mark and Anne both shared their early-life budgeting processes with the students.

“What I did is I kept a little notebook in my pocket, and every time I purchased anything, cash or check, I wrote it down,” said Mark. “I did this for months, and after about three months, I could look at my history and know what it cost me to live.”

He then knew how to live within a budget because he carefully tracked the numbers.

A call to action: HireSmart Cares aims to help youth realize their potential

Mark said banks make a fortune off overdraft fees and urged students not to help banks make their offices bigger by incurring unnecessary and expensive overdraft notices.

“Whatever works for you,” he said. “Develop a system of tracking expenses so you don’t pay overdraft fees.”

Anne shared her former system of budgeting by envelopes. She talked about days of living lean and working to make a little bit of money last.

“When I got my paycheck, I ended up taking it and cashing it, and I put it in envelopes,” she said.

There were envelopes for rent, car payments, gas, food, utilities, and entertainment. Anne talked to students about “fixed” costs, such as rent and car payments, versus “variable” expenses, such as food and entertainment.

She put her cash into each envelope every pay period. When an unexpected expense arose, she had to determine which envelope went light.

“Let’s say I have a situation where my car breaks down, and I have to do repairs,” she said. “Where does that money come from? I only have so many envelopes.”

Anne shared the necessity of firm budgeting priorities and a hierarchy of needs. She said rent, auto, and gas expenses came first. She needed a place to live and transportation to work. When unexpected costs came, she pulled first from entertainment funds and next from food. Anne added this system helped her positively refine her decision-making.

“If I only have $20 for entertainment for the month, maybe I’m not buying that $7 Starbucks latte,” she said.

Mark and Anne also talked to the students about good debt versus bad debt, explaining that good debt has a positive return on investment, while bad debt continues to bite into your wallet for years. They urged students not to be on the wrong side of compound interest.

They noted that taking on major debt for college without a viable repayment plan is financially destructive, with debt payments increasing over the years because of compound interest. They urged students to consider working through college to pay as they go or to see which employers have a tuition reimbursement program.

“Think about your income potential after college,” said Anne. “We often see kids saddled with $100,000 worth of debt, and their earning potential is $40,000 a year.”

Mark talked about how powerful compound interest can be for students if they save money over time and invest it wisely in interest-bearing accounts.

“So compound interest can work for you in savings and against you in a loan,” he said.

Along those lines, Anne advised students to “beware of credit cards,” noting the high-interest rates that saddle young people with debt.

“They (credit card companies) make it sound so interesting, but it can get you into bad trouble,” she said. “Don’t try to live over what you earn because that will get to you.”

High schoolers are zooming toward the days of paychecks, rent, insurance, and other adult concerns. Mark and Anne want the next generation to face those challenges with skill and confidence. That’s why HireSmart Cares allocates time, tools, teaching, and technology to those efforts.

To learn more about HireSmart Cares or to make a donation to the nonprofit’s mission to empower today’s youth through skill-development initiatives, visit hiresmartcares.org.